What Does Investment Consultant Do?

What Does Investment Consultant Do?

Blog Article

The 7-Minute Rule for Ia Wealth Management

Table of ContentsThe Of Investment RepresentativeGetting My Investment Consultant To WorkThe Buzz on Lighthouse Wealth ManagementMore About Investment ConsultantThe Definitive Guide for Investment ConsultantThe Greatest Guide To Lighthouse Wealth Management

Heath can be an advice-only planner, meaning he does not manage his consumers’ money immediately, nor does he offer them particular financial products. Heath says the selling point of this process to him is the fact that the guy does not feel bound to provide some product to resolve a client’s cash issues. If an advisor is only prepared to sell an insurance-based means to fix problems, they may become steering someone down an unproductive course in the name of hitting income quotas, he says.“Most monetary services folks in copyright, because they’re settled according to the services and products they offer and sell, they may be able have motivations to suggest one plan of action over another,” according to him.“I’ve selected this program of activity because i could hunt my personal consumers in their eyes rather than feel just like I’m taking advantage of all of them by any means or attempting to make a sales pitch.” Story continues below advertising FCAC notes the way you shell out the advisor depends upon the service they give.

Not known Details About Private Wealth Management copyright

Heath and his ilk tend to be settled on a fee-only design, this means they’re paid like a legal counsel can be on a session-by-session basis or a per hour assessment price (private wealth management copyright). With regards to the array of solutions while the knowledge or typical clients of one's expert or coordinator, per hour fees vary in 100s or thousands, Heath states

This is up to $250,000 and above, he states, which boxes

The Ultimate Guide To Private Wealth Management copyright

Story goes on below advertising choosing the best financial planner is a little like dating, Heath says: You want to find some body who’s reputable, has a personality fit and is also best individual for any phase of existence you are really in (https://pblc.me/pub/125e92e301503b). Some prefer their particular advisors as older with much more experience, he says, although some choose somebody younger who are able to ideally stick to them from very early many years through pension

The Ultimate Guide To Investment Representative

One of the largest mistakes someone can make in choosing a specialist is not asking sufficient concerns, Heath states. He’s surprised when he hears from consumers that they’re nervous about inquiring questions and possibly appearing stupid a trend he locates is just as common with established professionals and older adults.“I’m shocked, since it’s their funds and they’re paying plenty fees to these people,” he states.“You need to have your questions answered and also you deserve having an open and honest union.” 6:11 Investment Planning for all Heath’s final advice applies whether you’re in search of outside financial support or you’re heading it alone: become knowledgeable.

Listed below are four points to consider and have your self when learning whether you need to touch the expertise of a monetary specialist. The internet really worth is not your income, but instead a quantity that can assist you already know what cash you earn, how much it will save you, and where you spend some money, also.

Tax Planning copyright - Questions

Your baby is found on just how. The separation and divorce is pending. You’re nearing your retirement. These and various other major existence occasions may encourage the necessity to go to with an economic specialist about your you could check here financial investments, debt targets, alongside financial matters. Let’s say your mother kept you a tidy sum of money within her will.

You might have sketched out your own financial plan, but have trouble keeping it. A financial advisor may offer the responsibility you need to put your economic anticipate track. They also may recommend simple tips to tweak your monetary program - http://www.video-bookmark.com/bookmark/6100844/lighthouse-wealth-management,-a-division-of-ia-private-wealth/ to maximize the possibility outcomes

What Does Financial Advisor Victoria Bc Mean?

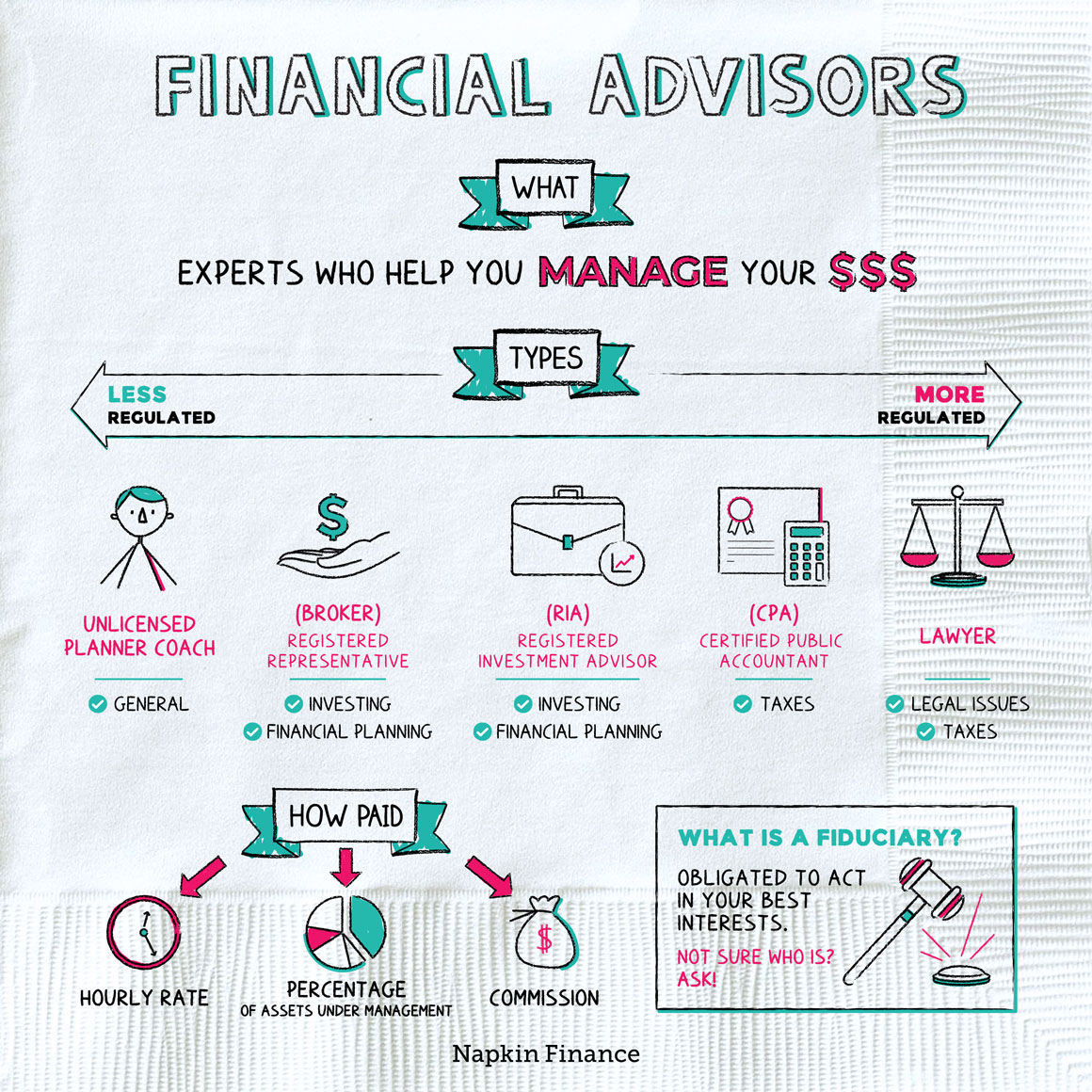

Anyone can state they’re an economic consultant, but a specialist with pro designations is ideally usually the one you ought to hire. In 2021, an estimated 330,300 Us citizens worked as personal monetary advisors, according to research by the U.S. Bureau of work Statistics (BLS). The majority of economic experts are self-employed, the bureau claims - tax planning copyright. Usually, you can find five types of economic advisors

Agents generally earn income on trades they make. Brokers are managed from the U.S. Securities and Exchange Commission (SEC), the Investment Industry Regulatory Authority (FINRA) and state securities regulators. A registered investment advisor, either people or a firm, is similar to a registered representative. Both buy and sell opportunities on behalf of their customers.

Report this page